1. What is the T/T payment?

T/T payment (Telegraphic Transfer), also known as wire transfer or swift transfer, is a standard payment method in trade. T/T wire transfer refers to the outbound bank, upon the request of the remitter, to send a telegram, telex or SWIFT to a branch or correspondent bank in another country (that is, the inbound bank) to instruct a certain amount to be paid to the recipient.

The T/T payment is used in international trade and settled in foreign exchange currency. The buyer remits the money to the seller’s bank account by foreign exchange. T/T is a type of remittance, is commercial credit. After the goods are ready, the seller will send the invoice B/L and packing list directly to the buyer without going through the bank.

2. The types of T/T payment

There are three types of T/T payment in international trade terms. Some are safe for the seller; some are safe for the buyer; it depends on how you negotiate with the seller.

T/T in advance(before shipment)

In the international trade business, before the shipper delivers the goods, Those who pay 100% of the purchase price are called TT in advance. This payment method is the safest trade method in international trade for the seller. The seller does not need to bear any risk; as long as the money is received, it will be shipped, and if the money is not received, it will not be shipped.

T/T payment with deposit

The second type is TT with deposit payment. The TT payment with deposit is defined as pay deposit before the goods are delivered. The buyer pays the deposit, usually 30% or 50% of the total amount. Then the buyer pays the balance against the B/L copy. Generally speaking, the payment with deposit is basically popular. The buyer first gives a 30% deposit, and the other 70% remaining balance paid against the copy of B/L. Of course, some have a 40% deposit and 60% on the B/L.

T/T after shipment

The TT after shipment is defined as after the goods are delivered, the buyer pays the balance. The TT after Shipment is based on the copy of the B/L to pay the balance. As the seller and buyer have done business for years, they may go with this option, ship the goods before payment. Pay the bill to close the invoice a few weeks later, even months, very similar to OA(open account payment terms).

3. The process of T/T payment

TT payment is used for remittances between companies and used to transfer money between companies and individuals, such as retirement wages, medical expenses, various labor fees, author’s remuneration, Etc. Also be applied to make related payments made by individuals to companies in other places, such as mail-order goods, books and periodicals, and university tuition.

The common T/T payment method process is as follows

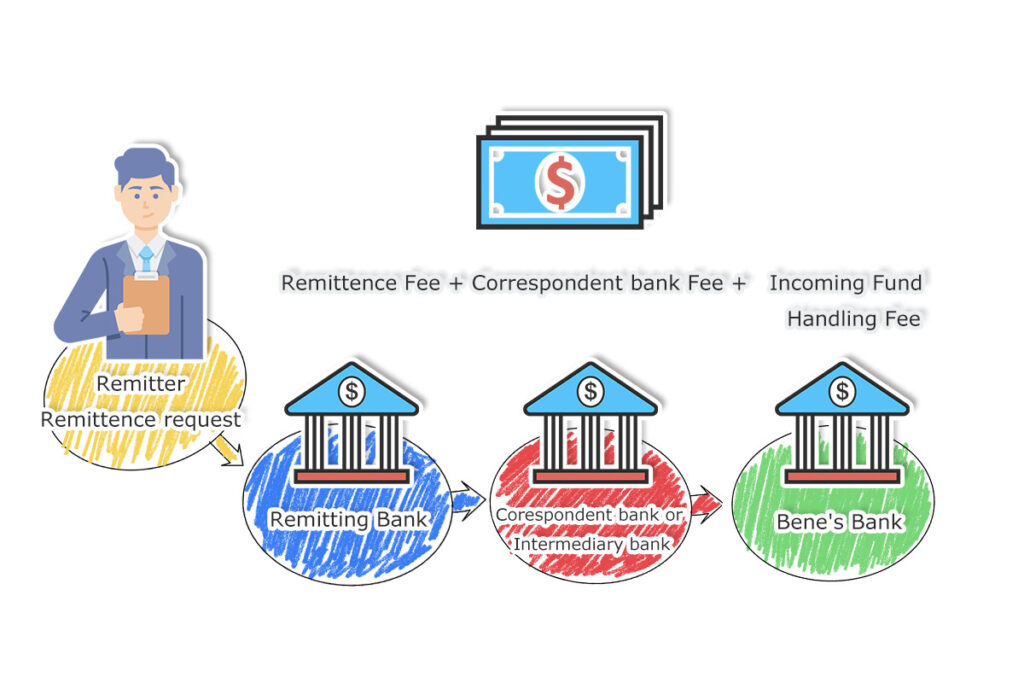

- The remitter fills out the wire transfer application form and pays to the remittance bank;

- The remittance bank issues a wire transfer receipt to the remitter;

- Remittance bank post transmission, telegram or SWIFT to the inbound bank;

- The remittance bank will send the wire transfer notice to the payee after checking the secret deferment;

- The payee stamps the receipt of the payment and delivers it to the remittance bank;

- The inbound bank debits the outbound bank account and settles the remittance to the beneficiary;

- The inbound bank will send the debit notice to the outbound bank.

In this way the T/T payment process is complete, and normally it take a few working days or even in one week the money showing up in Bene’s account.

The T/T payment process during international trade

- The buyer communicates with the seller and places an order send PO(Proforma order) to seller. Then the seller issues the PI (Proforma Invoice ) to the buyer, agree on products, quantity, price, payment terms etc, .

- The buyer sign the PI and send a copy to seller then remit money according to the seller’s PI, normally 30% of total amount.

- The seller start produce products or preparing goods depends on what kind of products the buyer chooses.

- Before shipment buyer may transfer the balance to seller according the PI.

- The seller arranges delivery and provides transportation documents such as invoices and packing lists .

- The broker agent is responsible for transporting and receiving the goods and notifying the buyer, letting the buyer decide and inform in writing whether the goods enter the bonded warehouse.

- The buyer pays import taxes to the broker agent. broker agent help handle customs clearance procedures, ship goods to buyer and provide import tax forms.

3. How to make T/T payment

Generally, the current payment process is to prepay 30%. The seller will give the buyer their company’s U.S. dollar account. The buyer will remit money according to the account number. Normally, the bank will deduct a handling fee ranging from $5 to $75. After the remittance, the buyer will receive the payment within a few working days or even in one working day.

And the 70% down payment needs to balance before or after shipping. After the goods are shipped, the seller must firmly have the original bill of lading or the bill of lading to be stamped with the electricity release seal in hand. They will send the cargo documents and the COPY bill of lading to the buyer and let them remit the balance. After they receive the down payment, the bill can be issued to the buyer.

In this way, the T/T process is complete. Here’s the quick guide on how to make a T/T payment(oversea) online, based on OCBC bank.

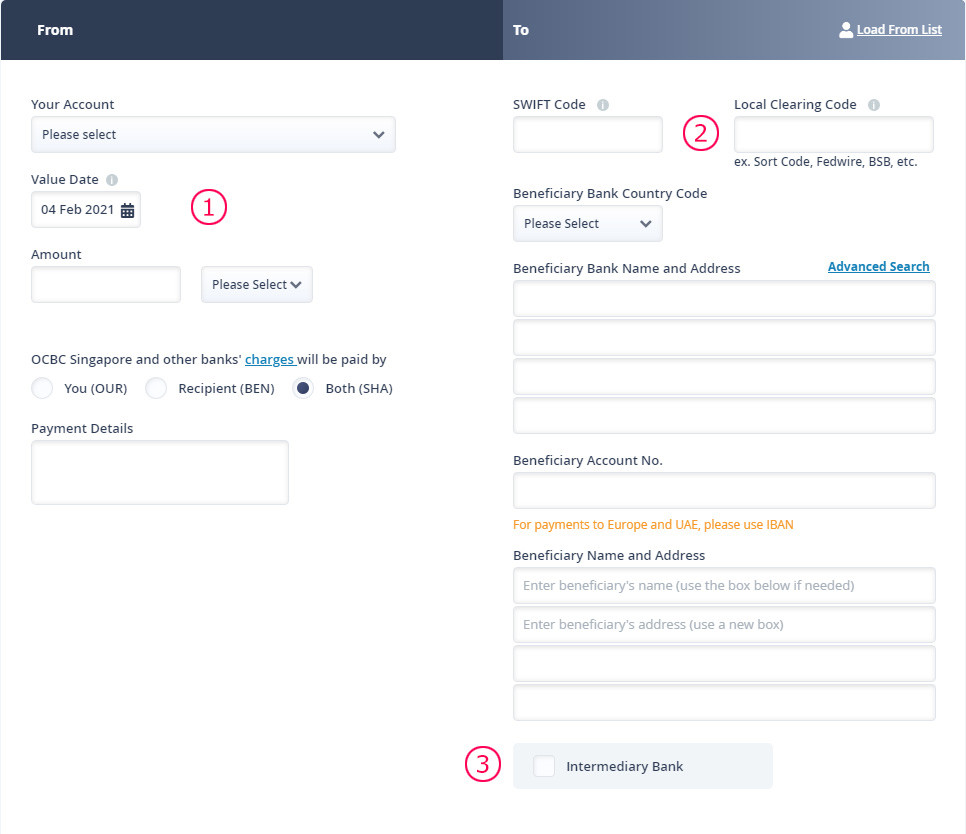

1. The first step:

- Select your Account and Value Date

- Input Remit Amount and Currency

- Choose the Charge Type – refer to table below for more details

- Enter Payment Details (mandatory) – Inform, Beneficiary of payment nature, such as “consultancy fee, invoice no. xxx”

2. The 2nd step:

- Enter SWIFT Code and select from the dropdown list. The following information will be auto populated.a. Beneficiary Bank Codeb. Beneficiary Bank Name and Address

- If Beneficiary provides a different address from the populated information, you may key in under Information to Beneficiary Bank.

- For Local Clearing Code if it is provided, to input i.e. China CNAPS/UK Sort Code etc.

3. The 3rd step:

- Enter Beneficiary Account Number – for payment to Europe and UAE, key in the full IBAN number.

- Enter Beneficiary Name and Address – ensure Beneficiary’s name is in full. If there is insufficient space, continue to the next line. Additional information may be input under Information for Beneficiary Bank.

- Enter Intermediary Bank (Optional) – Bank details which the Beneficiary Bank maintains account with. Check with your Beneficiary if this information is required.

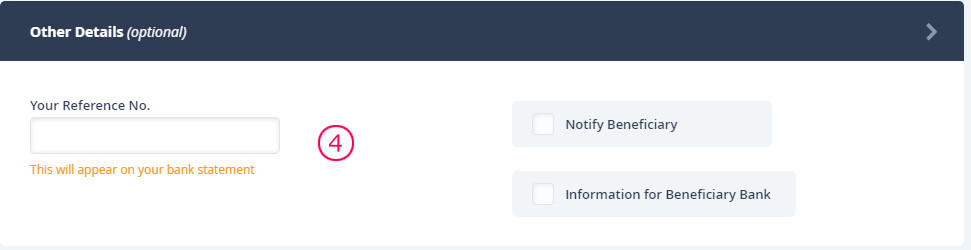

4. The 4th step:

- Click on Notify Beneficiary, to notify the Beneficiary via email once Transaction Status changes to Successful.

- If there are additional details to inform the Beneficiary Bank, please input under Information for Beneficiary Bank.

- Click on Save or Submit (*refer to Notes), after ensuring all the relevant fields are entered.

Note: The handling fee has three options, You, Recipient, and Both. If you choose you, then you send 10,000 USD, the seller will get exactly 10,000 USD; choose recipient, the seller will get 9,970 USD; choose both, the seller will get 9,985 USD.

5. Is T/T payment safe when pay to Chinese suppliers?

T/T payment itself is secured and safe; this risk is from dealing with the Chinese suppliers or the SCAMMER. T/T is a commonly used payment method in trade, and the handling fee is also lower. At the same time, the risk is relatively higher than LC.

Here’s the checklist for you to prevent SCAMMED when making a T/T payment.

(1) Send the money legally. Many buyers suffer from the bank accounts frozen in the last year. China is cracking down on underground banks, so please check this article:Is it still SAFE to send money to China? to avoid this kind of risk.

(2) Don’t send money to an unknown seller by T/T. If you are dealing with a new seller online, it’s very hard to figure out. The reality is the SCAMMER professionals, and the goods do not exist, the price is very low, once they got your money, you will get nothing. It’sIt’s better to go with LC, PayPal, or ESCROW payment.

(3) Double-check the account No before you move on. You receive an email from your Chinese supplier that they changed the bank account. Sometimes the seller’s email accounts have been hacked, or the SCAMMER registered a very similar email account. For example, info@mydomain.com use info@mydomains.com to send you an email. If you send money to the new account, it will be a disaster.

Some suggest:

Any errors in the transfer details will cause tremendous delays.

Many customers are careless and will miswrite the payee’s name. For example, if the name is too long, the remittance is limited by the filling space, etc., the remittance does reach the payee. However, due to incorrect information, there is no way to release the funds.

Processing result: Generally speaking, if it is not resolved within 15 days (or according to the actual situation of each bank), it will be returned the same way.

Suppose the company name is too long . In that case, you can write the part of the name in the address bar, and the payment will collected smoothly.

Need help for setting the payment terms with suppliers?

Just feel free to fill the form below, and we’ll give you a suggestion or quotation, our company MySourcify will try our best to help you.

So that’s it.