Before we start, please make sure this article can apply to your business:

- This article is about selling goods to buyers from an EU member state, not UK, not US, not any European countries that are not EU members.

- This article is for distance sellers from non-EU member state countries. For EU sellers or if your storage is located at any of the EU member states, you can apply for OSS or VAT according to your scale of selling.

- This article is for small quantity sellers like dropshipping sellers. If you are a bulk seller, most probably you will have to stick to the traditional VAT declaration and clearance at the customs.

OK, in a nutshell. If you are a dropshipping seller from countries outside of the EU, perhaps UK, and your customers include buyers from EU member states, such as France, this is the right article for you!

What is IOSS?

The EU has announced a new regulation on VAT for importing goods from outside countries, to replace the previous VAT-free policy for goods under EUR 22. From 1 July 2021, all commercial goods imported into the EU from a third country or third territory is subject to VAT irrespective of their value.

The Import One-Stop Shop (IOSS) was created to facilitate and simplify the declaration and payment of VAT for goods sold from a distance by sellers from either the EU or from a non-EU country or territory. Furthermore, VAT payment is applicable only to purchases made by a buyer within the EU and for goods valued at less than EUR 150.

Why should I use IOSS?

As you could notice, the up-limit of using IOSS is EUR 150 per bulk of goods, which means this service is specifically designed for B2C sellers, especially dropshipping sellers. Instead of having to go through the whole VAT reporting and payment process for EACH BULK of goods as B2B sellers do, small quantity sellers are largely benefited from this service.

Now with this serving platform, you would only need to report the value of your goods into the EU on the last day of every month, and pay VAT in sum before the last day of next month, just like paying taxes in your hometown. This service could largely lessen your workload and make your cash flow more smoothly.

How do I get an IOSS number?

First thing first, you have to register and get an IOSS VAT identification number. At present, the EU only accept registration from intermediary companies at an EU member state for IOSS number, which means you will have to search for them and get an IOSS number.

You may search the web for an intermediary company, and contact them to require an IOSS registration service. They may require you to provide the following information:

- Business license

- Legal person passport

- Registration form

- Articles of Association

- Import and export license

Once everything is all set, you may get your IOSS number around 5-7 weeks.

How do I work with IOSS?

For the detailed working process, it could be different according to your identity. Check the following information that matches how you sell your goods. Some sellers may have multiple identities, then make sure all the information is acquired.

I am a seller with my own store, integrated with Shopify, WooCommerce, Shopee, etc.

Let’s go through a checking list to make sure you get everything in order.

- Be sure to include VAT in the product prices at your store, you definitely don’t want your buyers to pay surprise fees, which will affect the customer experience and in turn reduce your store rate.

- As you have successfully registered for an IOSS VAT identification number, be sure to provide it to your cooperating shipping agency. If you are handling the shipping of every order by yourself, make sure to send it to the shipping provider.

- Make sure the value of your goods for each order is under EUR 150. If any of your customers ordered goods over that value, split the order and send them on different days.

- Make sure to submit an electronic monthly VAT return via the IOSS portal of the Member State where you are identified for IOSS.

- Be sure to make the VAT payment according to the return before the last day of next month.

- Ensure keeping all records of sales for over 10 years.

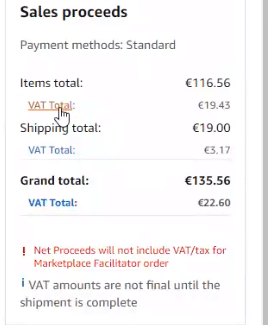

I am a seller at an online marketplace platform, such as Amazon, eBay, or Wish.

Consult with your marketplace for their IOSS number and send it to your shipping handler, make sure the value of your goods for each order or package is under EUR 150, and they will arrive at your buyer with no surprise fees.

No worries for you, as the VAT should be paid by the buyers whenever they make a purchase, and the marketplace as a whole taxpayer, would make regular VAT payments to their IOSS registration country.

Notice: Some platforms, like Wish, may not provide an IOSS number, and you have to register your own.

I am a seller with local storage and shipping services, such as FBA.

Same as non-FBA sellers, all your VAT should be charged by marketplaces from the buyers, and all you need to do is consult with Amazon or your platform for the OSS number, which is used by distance selling inside the EU, and send it to your shipping handler. This will allow you to apply the VAT rate of the warehousing country instead of changing to any else.

FAQ

Do I need to register for a VAT number if I have an IOSS number?

Technically, if you could control the value of your goods to be under EUR 150, you can keep working with IOSS, however, we strongly suggest you register for a VAT number, in case any accident happens.

What if I do not register for an IOSS number?

If you do not have an IOSS number, when your goods arrive at the destination, they will be intercepted by the destination customs, and you need to process customs clearance one by one for the orders before they could get through to your customers.

Some delivery services already stopped delivering packages to EU member states if the sender could not provide an IOSS number, so when you processing the shipping for your goods, the numbers are actually essential.

How is the value of goods calculated?

Basically, the value of goods means the price that the customer paid for the product in your store, excepting shipping fee and insurance fee. However, if these are included in the price already, they should also be counted.

Here we take 3 receipts for example:

Receipt A

Value of Good: EUR 130

VAT(20%): EUR 26

Total: EUR 156

IOSS: can apply

Receipt B

Value of Good: EUR 130

Shipping Fee: EUR 20

Insurance Fee: EUR 10

VAT(20%): EUR 32

Total: EUR 192

IOSS: can apply

Receipt C

Value of Good: EUR 160

VAT(20%): EUR 32

Total: EUR 192

IOSS: CANNOT APPLY

Here we can see the differences, and you have to pay attention to high-value goods for their shipping fee inclusion. Some dropshipping sellers are good at integrating all charges, including VAT, shipping fee, insurance, etc. into the purchasing price, which may affect your use of IOSS service in this case.

What if my goods exceed EUR 150?

If this is the case, you need to contact your shipping agency or transport supplier to process customs clearance. Tariffs may be applied to your goods, and you have to finish the payment before your goods could get through.

How much do I need to pay?

The Vat amount will be determined by the destination country of your goods. Exact VAT rate differs in EU member states, and we have made a list for you to quickly check:

Austria 20%

Belgium 21%

Bulgaria 20%

Croatia 25%

Cyprus 19%

Czech Rep. 21%

Denmark 25%

Estonia 20%

Finland 24%

France 20%

Germany 19%

Greece 20%

Hungary 27%

Ireland 23%

Italy 22%

Latvia 21%

Lithuania 21%

Luxemburg 17%

Malta 18%

Netherlands 21%

Poland 23%

Portugal 23%

Romania 19%

Slovakia 20%

Slovania 22%

Spain 21%

Sweden 25%

Conclusion

IOSS is essential for individual store owners, and registration requires working with an EU intermediary. Be sure to provide your IOSS number to your shipping agent or transport supplier to make sure no surprise fees happen to your customer.

The VAT return should be submitted every month before the last day, and must be paid before the end of next month. The exact payment amount depends on the VAT rate of the destination country.

Thank you for reading this article, and if you have any questions, please feel free to contact us.