Payment has always been a top part not only in daily life, but also in business life. Money transfer from country to country can be troublesome. Want to make your money transfer safe and low in handling cost? This is what we are going to tell you in this article.

China, being a country powerful in import and export, has strict regulations on foreign currency exchanges. When sending money to China, you need to pay attention that whether you are sending this money in USD or RMB? If you are sending in RMB, then how?

This article would illustrate some commonly used methods to send money to China. Now let’s move on to these methods in details.

1. PayPal

#1 Basic Information about PayPal

| Details | |

| Min. Transfer Amount | $1 |

| Max. Transfer Amount | $10,000 |

| Transfer Methods | Online Bank Account to Bank Account Cash Transfer |

| Transfer Speed | 3-5 days |

#2 How to send money through PayPal

1. Make a PayPay account.

2. Adding money to PayPal, or connect your bank account to PayPal.

3. If your recipient do not have a PayPal account, ask him to do the above steps.

4. Send money when both of your accounts are ready.

#3 PayPal Fees

| Funding Method | Destination Country | Fees |

| PayPal balance or linked bank account | U.S. | $0 |

| Credit card, debit card or PayPal Credit | U.S. | 2.9% of transaction amount + $0.3 |

| PayPal balance or linked bank account | Any other country | 5% of the transaction($0.99 Min., $4.99 Max.) |

| Credit card, debit card or PayPal Credit | Any other country | 5% of the transaction($0.99 Min., $4.99 Max.) + 2.9% of the transaction amount + $0.3 |

#4 Pros & Cons

Pros

1. Fast transfers to other PayPal users.

2. It’s quite safe to use PayPal for money transactions.

3. PayPal is a worldwide money tool, available in over 200 countries. But currencies PayPal supports are limited to 20+.

Cons

1. Its international transfer can be expensive. It’s better for small amount of transactions if you are sending money from country to country.

2. Its exchange rate is below the mid-market rate.

3. PayPal charges a high cost of $35 for every withdrawal.

2. Western Union

#1 Basic Information about WesternUnion

| Details | |

| Min. Transfer Amount | $1 |

| Max. Transfer Amount | $5,000 |

| Transfer Methods | Online Bank Account to Bank Account Phone Agent International Money Order |

| Transfer Speed | 3-5 days |

PS: About Transfer Speed

It depends on the amount of fees you want to pay and how quickly you need it to arrive.

- Fastest Option—-Within 10 minutesPay for your transfer with a credit or debit card and have it sent for cash pickup. When using a credit or debit card, you’ll typically pay a higher fee. And your credit card may charge a cash advance fee, further increasing the cost of your total transfer.

- Cheapest option—-3-5 business days

Using a bank account to pay for your transfer is typically the cheapest way to send money, but is also almost always the slowest. Depending on verification needs you may have to wait longer while Western Union confirms you own the registered bank account.

#2 How to Send Money through WesternUnion

1. Register a Western Union account.

2. Choose a valid payment method. It depends on whether you want it cheapest or fastest.

3. Recipient’s contact information.

- Bank Name

- Account Number

- Recipient’s Name

- Recipient’s Address

- Phone Number

4. Your contact and payment information. This information is needed by the recipient for collection.

- Card Number/Account Number

- MTCN Number

- Sender’s Name

- Actual Amount

- Recipient

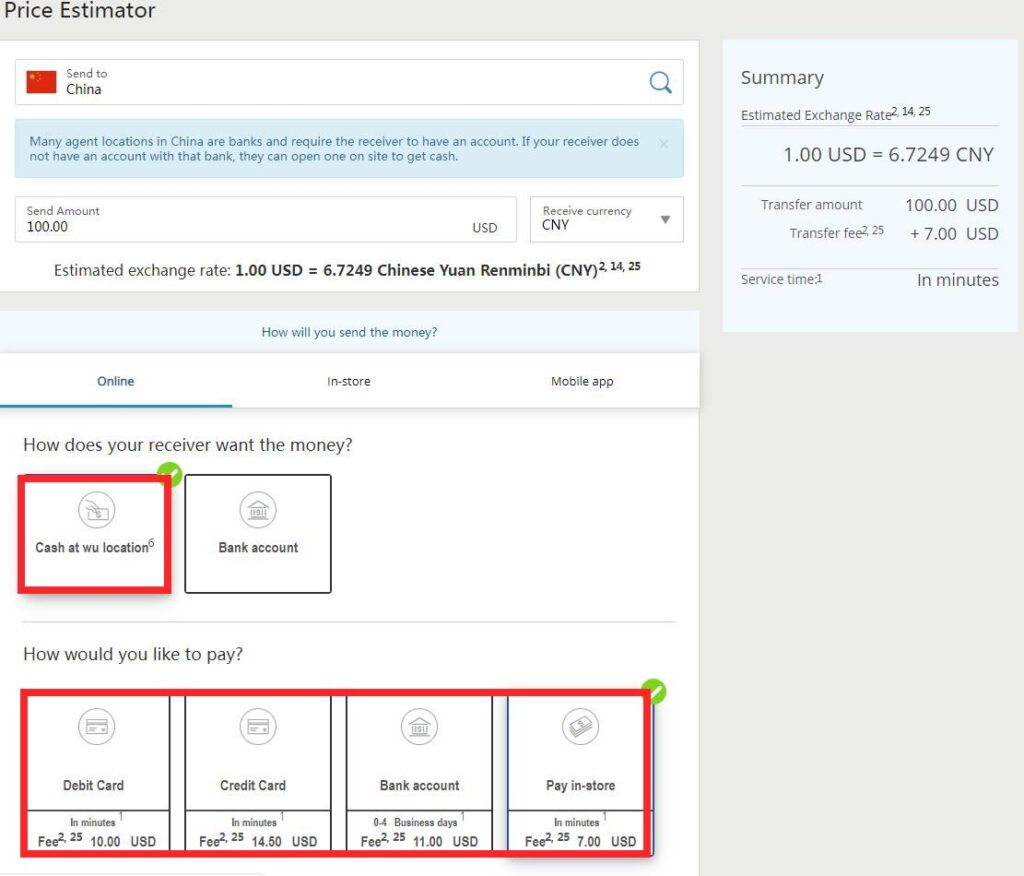

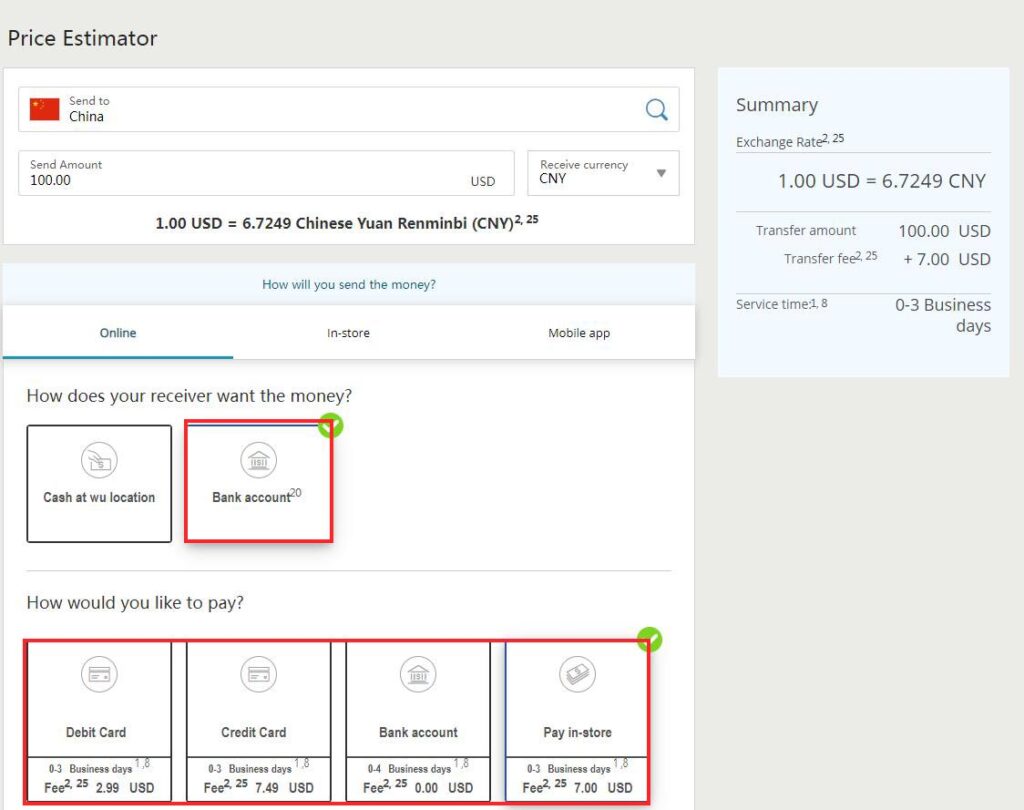

#3 Transfer Fee

Western Union has different fees for nearly every country it sends to. These fees mainly depend on the following 4 factors:

- Location.

- Payment.Paying with a credit card, a debit card or a band account will have different fees.

- Receiving method.Picking up cash can be more expensive than sending directly to a bank account.

- Variable exchange rates.Western Union applies different exchange rates to different transfer types. It also uses stronger or weaker exchange rates based on the currency you are transferring.

You can also calculate all the transfer fees by price-estimator on its official website, which can give you a more vivid comparison.

#4 Pros & Cons

Pros

1. It provides money transfer worldwide.

2. It provides flexible transfer options. You can choose to pay with credit card, debit card, bank account and more, depending on your needs.

3. The transfer speed is fast. Some can be received within minutes, which on the other hand is more costly.

Cons

1. Exchange rates offered by Western Union can be as high as 20% worse than the mid-market rate.

2. Its maximum transfer limits is a week. You can only send a maximum of $2,999 per online money transfer.

3. Nearly all transactions through Western Union will have a fee attached, and some are quite expensive.

3. Transfer Wise

#1 Basic Information about TransferWise

| Details | |

| Min. Transfer Amount | $1 |

| Max. Transfer Amount | $1,000,000 |

| Transfer Methods | Online |

| Transfer Speed | 1-2 days |

#2 How to Send Money through TransferWise

1. Register a TransferWise account.

2. Enter your sending amount.

3. Fill in recipient’s bank account information. It will specially need the UnionPay card number.

4. Verify your identity.

5. Then you are ready to make your transfer.

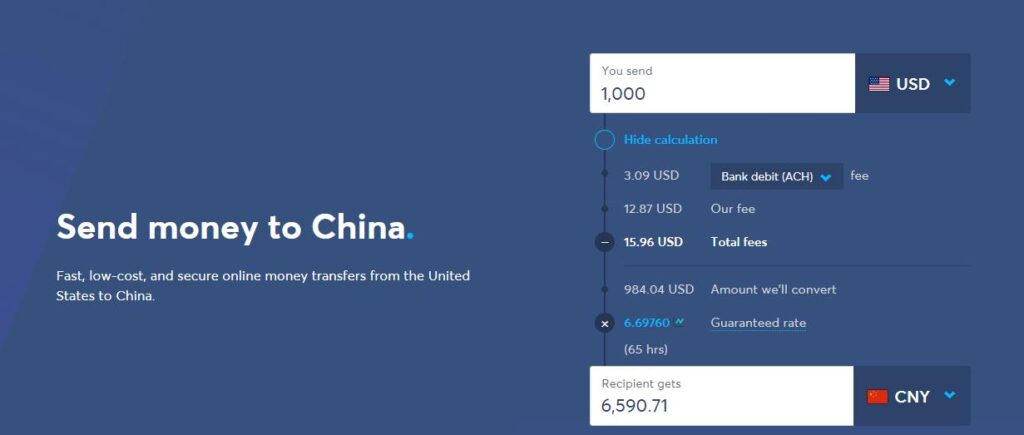

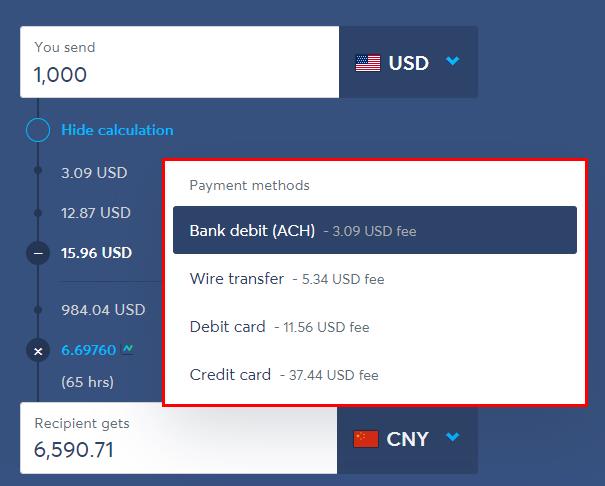

#3 Transfer Fee

TransferWise fee is calculated based on these 2 factors:

- Amount.

The more money you send, the higher your fees will be. - Payment method.Paying with a credit card, a debit card or a band account will have different fees.

Here we have a table for your reference only. It shows its transfer fee on April 13, 2020.

| Payment Fee | TransferWise Fee | Total Fee | |

| Bank debit (ACH) | 0.35% | 0.5%-1% | 0.85%-1.35% |

| Wire transfer | 0.53% | 0.5%-1% | 1.03%-1.53% |

| Debit card | 1.24% | 0.5%-1% | 1.74%-2.24% |

| Credit card | 3.66% | 0.5%-1% | 4.16%-4.66% |

#4 Pros & Cons

Pros

1. It is easy to operate.

2. It offers the mid-market rate on all transfers sent through its network.

3. It has a high daily sending limits, up to $1,000,000 per transfer. But it depends on sending methods and locations.

4. Able to pay with credit card, debit card, bank account with ACH or wire transfer.

Cons

1. Funds must be sent to the recipient’s bank account; there is no option for cash pickup.

2. You’ll have to provide your SSN and possibly other identification before sending your first transfer.

3. Its transfer fee can be relatively high.

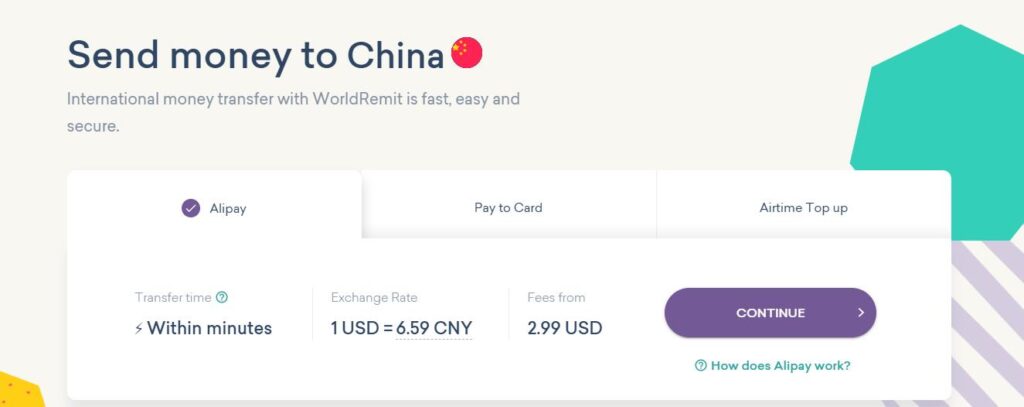

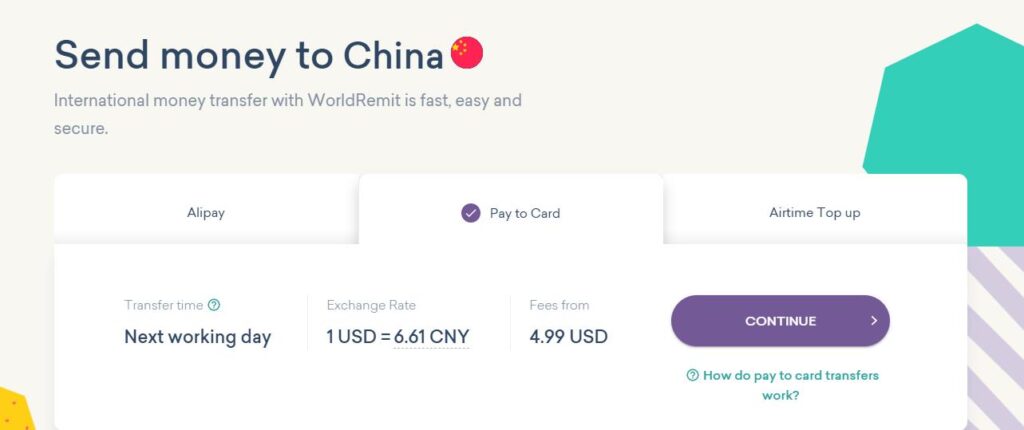

4. World Remit

#1 Basic Information about WorldRemit

| Details | |

| Min. Transfer Amount | $1 |

| Max. Transfer Amount | $9,000 |

| Transfer Methods | Online Bank Account to Bank Account Cash Transfer |

| Transfer Speed | Within an hour |

#2 How to Send Money through WorldRemit

1. Choose the country you want to send to.

2. Select the method.

You can choose to send to Alipay or card, when sending money to China. Using Alipay is quite convenient for Chinese suppliers.

3. Enter the amount you are sending.

4. Fill in recipient information & payment information.

5. Then you are ready to make your transfer.

#3 Transfer Fee

Normally, if your are sending money to China, the fee for most transfers will be $3.99. However, it depends on the amount and payment methods.

#4 Pros & Cons

Pros

1. It is easy to use.

2. It offers flexible payment methods. You can pay with credit card, debit card or bank account.

3. Its money transferred can be received within minutes, which is quite time saving.

4. You can use WorldRemit to send money to Alipay, which is quite attractive for Chinese suppliers.

Cons

1. Transaction limits depend on how you are sending the money, while a total 24-hour cap of $9,000 applies to all transactions being sent by you out of the US.

2. Depending on where you are sending to, how you are paying and how you are transferring money, your fees may vary.

5. MoneyGram

#1 Basic Information about MoneyGram

| Details | |

| Min. Transfer Amount | $1 |

| Max. Transfer Amount | $10,000 |

| Transfer Methods | Online Bank Account to Bank Account Cash Transfer Agent International Money Order |

| Transfer Speed | Within an hour |

#2 How to Send Money through MoneyGram

Generally, MoneyGram is quite similar to Western Union, and the way it operates is almost the same. As for transfer fee, it is also identical to Western Union. Therefore, we won’t talk too much about it.

#3 Pros & Cons

Pros

1. It is widely reached in more than 200 countries and regions.

2. Customers can send money both online and in-person. You can pay using credit and debit cards, bank wires and cash.

3. Its money transferred can be received within minutes, which is quite time saving.

Cons

1. When sending online with MoneyGram, your transfer is limited to $10,000 per transaction. There is also a $10,000 per month limit.

2. MoneyGram’s international and domestic transfers incur a fee. Fees are often higher when paying with a credit or debit card and lower when sending from bank account to bank account.

6. Pay with Alipay

Payment would be much easier and quicker if you have an Alipay account. About how to register and use an Alipay account, we have another helpful article for your reference: How to Register an Alipay Account Outside China.

Hope this article will help you with your money transfer to China. Leave your sweet comment below to let us know if we have further to improve. Thanks for your support.