One of the most important thing to do when you’re importing from China is to check the credit status of the suppliers you’re working with. In this way, both the suppliers and buyers can establish trust. And at the same time, high risks can be avoided.

1.What is business credit report?

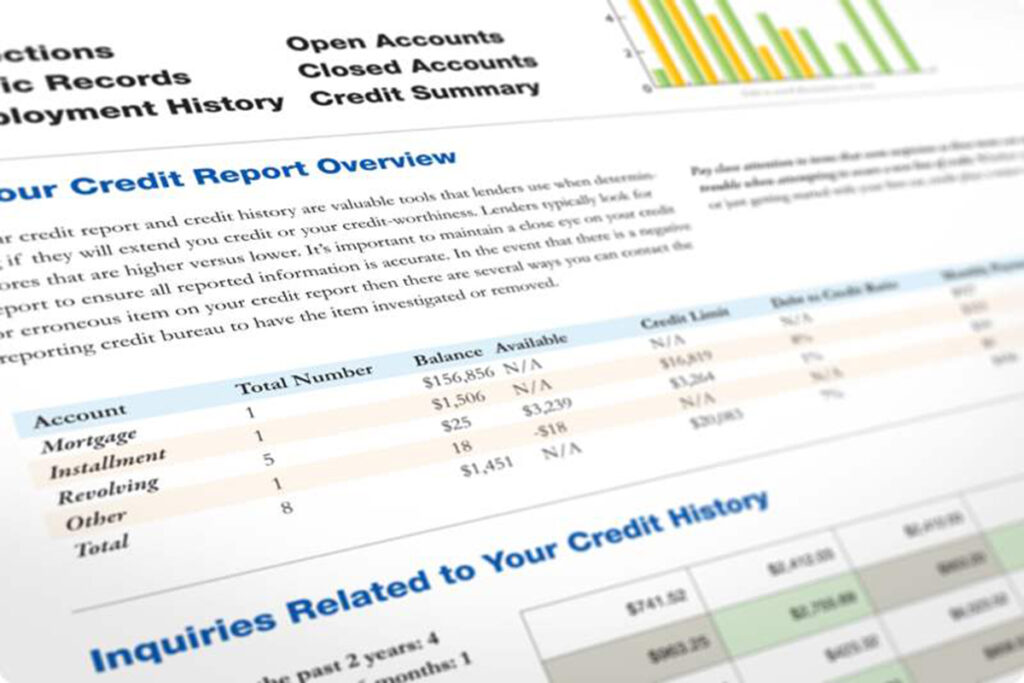

A business credit report is an aggregate of a company’s credit history. It allows you to evaluate the credit worthiness of your suppliers, before entering into a business relationship with a new company. And a professional credit report includes factors listed below.

| Report Content | Details | Report Content | Details |

| Identification | 1. Subject name 2. Alternate style 3. Operating address 4. Telephone/Fax/Email 5. Website | Corporate Affiliations | 1. Business name 2. Affiliation type 3. Address |

| Credit Risk Rating | 1. Risk rating 2. Interpretations 3. Full analysis 4. Credit limit 5. Country payment norms | Bank & Financing | 1. Lisk of banks Bank name Address Relationship type Account number/s 2. Charges & mortgages |

| Registry Data | 1. Date established 2. Legal form 3. Registration number 4. Registry authority 5. Fiscal/Tax id number/s 6. Registry status 7. Previous names | Operations & History | 1. Brief description 2. Full description 3. Brands 4. Local sources 5. Imported sources 6. Export destinations 7. Recent events 8. Trade bodies 9. Industry trends 10. History |

| Legal Filings | 1. Bankruptcy filings 2. Court judgments 3. Tax liens 4. Other | Property & Assets | 1. Description of premises 2. Branch locations 3. Other property 4. Capital equipment 5. Patent and certificates |

| Management & Stuff | 1. Executive officers 2. Numbers of employees | Financial Accounts | 1. Filing requirements 2. Sources 3. Presentation style 4. Date of accounts 5. Currency 6. Exchange rate 7. Financial highlights Sales turnover Pre-tax profit Net profit Total current liabilities Total long term liabs Total liabilities 8. Additional financial 9. Ratios and analysis |

With such a professional credit report, you would know if this supplier is trustful and worth working with.

2.How to run a business credit check?

Since it’s important to run a business credit check, but how? Take the following steps and you will have a clue.

Step 1: Acquiring Business Information

To get a business report, you will need to acquire some basic information about the company, including its name, address and etc. You can get these information from the company’s website. Or you can search it some online directories that contain business information.

Step 2: Run a business credit check

Normally, you can run a business credit report through online agencies. When choosing a credit agency, make sure it’s a well established and well known for its credit reporting.

Therefore, before working with suppliers, make sure you check their credit status and don’t get cheated.

Hope you find this article helpful. Let us know if we have further to improve and the topic you are interested in about importing from China. Thanks for supporting us.